5 Benefits Of Using A Proforma Invoice

Most of the customers, prior to incurring the cost for goods and services, try to get an estimate regarding the approximate amount they will have to pay. In such a situation, a regular GST invoice is not suitable. To help the customers or buyers in such a situation, the seller or client provides them with a proforma invoice.

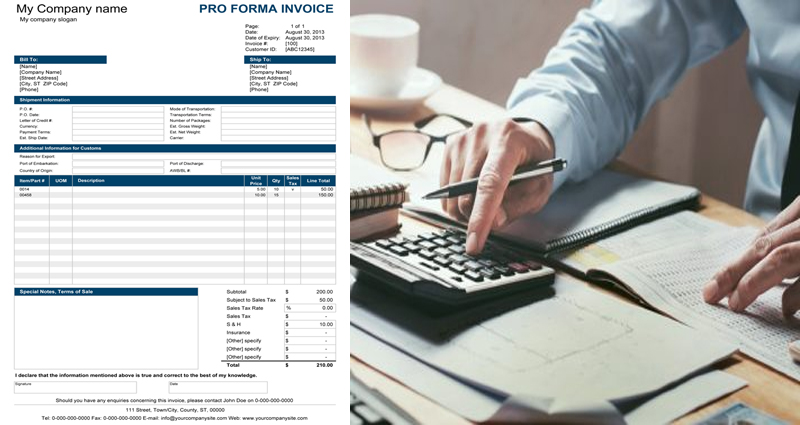

A proforma invoice format is not to be confused with that of a regular invoice. The key purpose of a proforma invoice is to give the customers a rough estimate of the expenses they will have to make for the said good or services.

The proforma invoice format is constituted of information like time and date of the delivery of the products, the approximate charges to be borne including those name of the sender and the customer to whom the product is sold and various other terms and conditions.

The proforma invoice … READ MORE ...